Submitting Invoices

Submitting invoices through the Coupa Supplier Portal (CSP) allows for faster invoice processing, automated invoice to purchase order matching, and visibility into invoice status.

01

Invoicing Against a PO

A legal entity must be set up before you can begin invoicing. If you have not created a legal entity yet, see our Setting Up E-Invoicing in Coupa page.

From the Coupa Supplier Portal homepage, click on the Orders tab. You can invoice against a PO by clicking on the Stack of Gold Coins or by clicking into the PO.

02

Creating a Non-PO Backed Invoice

A legal entity must be set up before you can begin invoicing. If you have not created a legal entity yet, see our Setting Up E-Invoicing in Coupa page.

From the Coupa Supplier Portal homepage, click on the Invoices tab. Select the Create Blank Invoice button if there is no PO to invoice against. With a blank invoice, item information must be manually entered and all items you are invoicing for must be listed.

Tessera does not issue PO's "after the fact". Follow the steps below to continue creating an invoice.

03

Invoicing Details

The Create Invoice page will appear and a box will pop-up to Choose Invoicing Details.

Select your company's Legal Entity. The Remit-To and Ship From Address fields will auto-populate from the information entered when the legal entity was created.

If your company has more than one Legal Entity, select the bank account listed in Remit-To that aligns with the bank account you intend to receive funds.

Click the Save button.

04

General Information

Fields marked with a red asterisk (*) are required.

Invoice #

Must be unique and not previously used. Coupa will verify if that invoice number has already been used.

Invoice Date

Will default to "today's" date. The date may be changed to reflect the date goods were shipped or services were completed.

Currency

Must align with the currency of the PO.

Attachments

Only to be used for additional support for the invoice

05

Purchase Order Lines

Lines

All line items on the PO you are invoicing against will be included under the Lines section of the invoice. To remove an item that you do not need to invoice for yet, click on the Red X Icon next to the line item you need to remove.

If invoicing for a purchase order that includes services for the current year plus additional years, you will need to remove the additional years and only invoice for the current year of service.

All service purchase orders will be amount based, so you will have the ability to invoice against the same purchase order until funds have concluded.

Line Level Taxation

If you need to add tax charges at the line-item level, click on the Line Level Taxation checkbox. A tax box will pop-up where you can enter the tax rate for that line-item.

Add Line

If you need to add additional items to this invoice that were not on the original PO, click on Add Line to manually enter the item description, quantity UOM, price and part number.

06

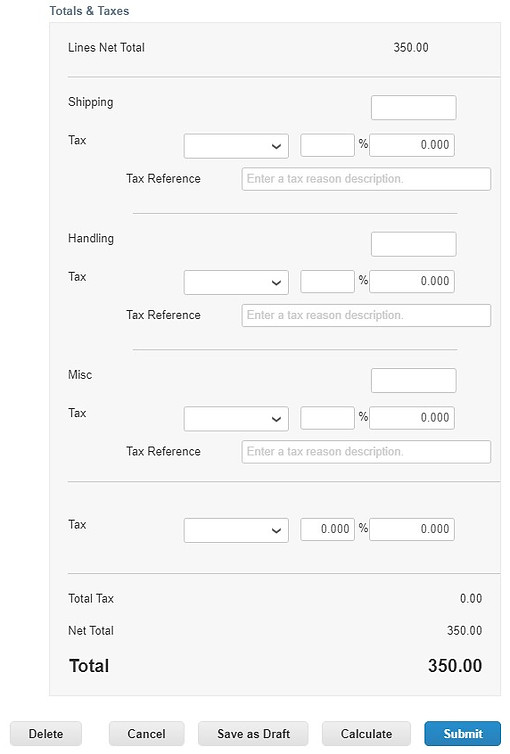

Totals & Taxes

Shipping, Handling, Misc, and Tax

Enter the Shipping, Handling, Misc, and Tax information pertaining to the order.

Click on the Calculate button. The invoice will refresh and calculate the new information entered.

Review invoice and select Submit.

07

Send Invoice

Are You Ready to Send?

Click on the Send Invoice box to send the invoice to Tessera or you may Continue Editing the invoice.

08

Invoice Status

From the Invoices tab, you have visibility to the status of each invoice submitted to Tessera.